Home Office Expense Deduction 2024 Limits

Home Office Expense Deduction 2024 Limits – The easiest way to claim a home-office tax break is by using the standard home-office deduction, which is based on $5 per square foot used for business up to 300 square feet. The “regular method” for . Stay updated on the standard deduction amounts for 2024, how it works and when to claim it. Aimed at individual filers and tax preparers. .

Home Office Expense Deduction 2024 Limits

Source : www.aaltci.orgSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comHome Office Tax Deduction in 2024 New Updates | TaxAct

Source : blog.taxact.comThe Home Office Deduction TurboTax Tax Tips & Videos

Source : turbotax.intuit.com25 Small Business Tax Deductions To Know in 2024

Source : www.freshbooks.comHow Working from Home Affects Income Taxes & Deductions (2023 2024)

Source : www.debt.org2024 State Business Tax Climate Index | Tax Foundation

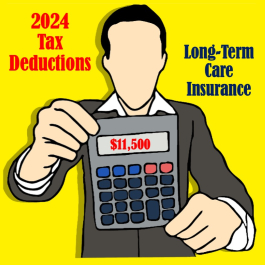

Source : taxfoundation.orgHome Office Expense Deduction 2024 Limits 2024 Tax Deductible Limits American Association for Long Term Care : Along with de-cluttering of Section 80C of the I-T Act, increase in the Section 80C deduction limit is also is considered as an expense. Individuals buying their home by taking a housing . Food insecurity is a real problem in the U.S. Here’s how to know if your household qualifies for food assistance this year. .

]]>